5 Easy Facts About What Happens If I Leave a Creditor Off My Bankruptcy Described

to concur without offering consent to generally be contacted by automatic signifies, textual content and/or prerecorded messages. Costs could use.

Depending on which type of bankruptcy you choose—Chapter seven or Chapter thirteen—you may need to repay a percentage of what you owe depending on your money situation and assets.

These further facts allow our Lawyers to realize a deeper understanding of the particulars of your respective situation

These further specifics enable our Lawyers to achieve a deeper idea of the details of your respective situation

Having said that, exceptions exist. For illustration, You can not cram down a car debt if you purchased the car through the 30 months before bankruptcy. Also, filers can not utilize the cramdown provision to reduce a residential property home loan. Learn more about decreasing loans using a "cramdown" in Chapter thirteen.

Any content that's place up on the web site is reviewed for clarity, fashion, and lawful accuracy ahead of becoming posted on our internet site.

The automatic keep will not be in place. Once you file your circumstance, an injunction (a style of court purchase) identified as the automatic remain goes into result to avoid creditors from continuing any assortment motion versus you.

If you leave a secured creditor off your creditor mailing listing, the implications are more critical. You should still deal with collection soon after your bankruptcy discharge. Secured debts are associated with a specific piece of house and so are not discharged in a bankruptcy, but this contact form They might be reaffirmed, surrendered, or reorganized. Your creditor needs to be linked to that process.

By submitting this kind I conform to the Conditions of Use and Privateness Policy and consent for being my explanation contacted by Martindale-Nolo and its affiliate marketers, and up to 3 attorneys relating to this request and also Go Here to acquiring appropriate internet see this page marketing messages by automated indicates, text and/or prerecorded messages with the range furnished. Consent is just not demanded as a affliction of support, Click here

Your vital obligation when filing for bankruptcy is To make certain to provide full details to the bankruptcy courtroom. Here's what could materialize for those who leave a creditor off with the mailing matrix:

A lot of bankruptcy filers start out acquiring credit card provides in a year or two of filing. Those delivers usually are for playing cards with reasonably high fascination rates and modest borrowing limitations, but applying them responsibly may help you rebuild a positive payment record, boost your credit history scores and at some point assist you qualify for more eye-catching credit history delivers.

If you file bankruptcy, you must checklist your property and debts inside your bankruptcy kinds. Technically, a charge card which has a zero harmony is now not a financial debt, therefore you don’t need to listing it on your own forms.

No matter if you'll be able to file A different Chapter 13 circumstance right away following a dismissed Chapter 13 will depend on The main reason why the Chapter thirteen case was dismissed. If this wasn’t your 1st bankruptcy case in a short stretch of time, the bankruptcy court could avert you from submitting Yet another Chapter thirteen case for a particular length of time. Even if you’re capable to refile without delay, your see this website automatic remain may very well be restricted.

Not like installment financial debt with a established payments agenda, bank card debt can snowball immediately due to compound desire and perhaps minimal minimum expected payments. As a result of those components, long run payment amounts is usually tough to forecast and deal with.

Angus T. Jones Then & Now!

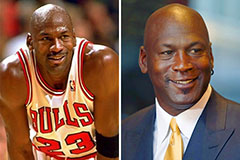

Angus T. Jones Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!